Conveyancers act for their clients to ensure the preparation of property transfer documents, review contracts, and handle property settlements. They play a key role in transferring property ownership.

When selling a property, a conveyancer can help with:

- Preparing and completing legal documents

- Representation and negotiation with the buyer

When buying a property, a conveyancer can help with:

- Researching the title

- Reviewing the contract of sale

- Calculating rates and land taxes payable

- Liaising with the bank

- Representation and negotiation with the seller

- Completing all legal documents

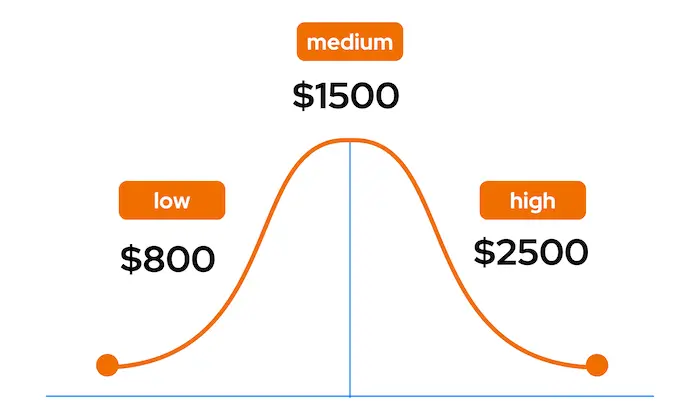

How much does a conveyancer in Melbourne cost?

Conveyancing fees in Melbourne range from $800 to $2500 for standard property transactions, depending on the business you select. Most conveyancers or property lawyers offer fixed fees that include disbursements.

Itemised costs, referred to as disbursements, are charged for legal documents such as property certificates, zoning/planning certificates and title searches, which leave the conveyancer out of pocket. These are necessary to facilitate accurate and smooth property transactions and vary between individual sales.

Generally, conveyancing fees are paid at settlement. Final adjustments are also made to ensure rates and utilities are up to date at the time of handover, including council rates, water rates, and body corporate/management fees.

Finally, conveyancers will liaise with financial institutions to trigger appropriate settlement payments.

How to choose a conveyancer

If you’re looking to compare quotes and prices, you can use Word of Mouth to post your job and receive three free quotes from local conveyancers.

We recommend choosing a conveyancer with a good track record of customer service and recent positive reviews. Scan reviews to see how responsive they are and whether they have kept customers informed throughout the process until settlement.

You can ensure a better chance of high-quality service by checking:

- Whether they are a member of the Australian Institute of Conveyancers

- If they are insured against Professional Indemnity

- If there’s a certain type of property niche or transaction they specialise in. i.e. land sales, complex sales, subdivisions or easements

- How long they’ve been in business

- How they communicate and engage with you and previous customers (check reviews)

Conveyancer vs solicitor - what’s the difference?

A conveyancer holds all the necessary licences and skills to handle property transactions. A solicitor is a lawyer who can perform the same tasks but has more comprehensive knowledge of the industry in general. For complex or commercial transactions, using a solicitor could be more beneficial.

A solicitor can also act for property transactions Australia-wide, whereas a conveyancer is typically limited to within their state border.

Final fees and complementary services

Once the conveyancer is paid at settlement, including all itemised disbursements/additional fees, there shouldn’t be anything further to pay. Any further fees or potential charges due to complexities with the property transfer should be communicated along the way before settlement.

A conveyancer is a key piece in your property acquisition network. When considering a property investment or purchasing a home, you may also need to engage a mortgage broker or financial advisor. Like a conveyancer, an excellent place to start is with reviews from professionals in your local area.